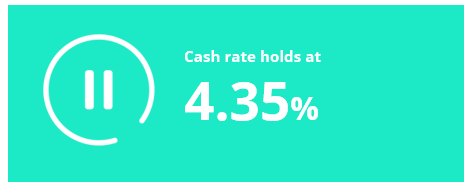

Reserve Bank of Australia Update - February 2024

In its initial gathering for 2024, the Reserve Bank of Australia (RBA) has opted to maintain the cash rate at 4.35 percent. The official statement for this decision is available on the RBA's website, and the subsequent cash rate determination is scheduled for March 19.

The most recent quarterly inflation data from the Australian Bureau of Statistics (ABS) indicates a decrease in the Consumer Price Index to 4.1 percent for the year ending in December, down from 5.4 percent in the September quarter. In the December quarter alone, inflation slowed to 0.6 percent, marking its lowest quarterly figure since March 2021.

Given these inflation metrics, numerous economists had anticipated that the cash rate would remain unchanged in the early part of 2024, with the possibility of a reduction in August or September.

In a recent survey conducted by CoreLogic, over 70 percent of real estate professionals expressed the belief that interest rates would exert the most significant influence on the housing market in 2024. The survey, titled 'Decoding 2024: Real estate's trends and goals revealed,' gathered insights from over 1,400 real estate professionals regarding the property landscape this year.

Among the survey respondents, 71 percent identified interest rate fluctuations as the primary driver for the Australian real estate market in 2024. Within this group, nearly 59 percent strongly believed that increasing rates would have the most substantial impact, while 12 percent foresaw some degree of impact from falling rates.

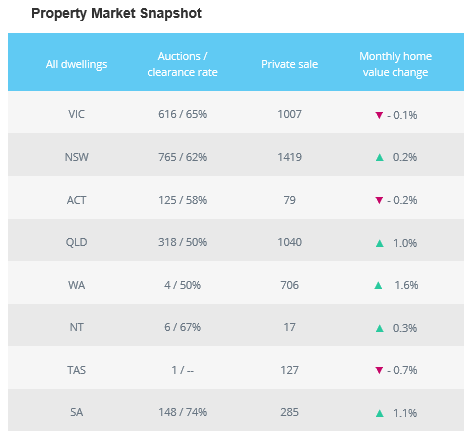

Eliza Owen, CoreLogic's Head of Residential Research Australia, shared the broad expectation that housing values in 2024 would still experience growth but at a slower pace than the 8.1 percent observed in CoreLogic's Home Value Index in 2023.

SELF-EMPLOYED AND LOOKING TO BORROW? A KNOWLEDGEABLE MORTGAGE BROKER MAKES ALL THE DIFFERENCE

For self-employed individuals navigating the Australian mortgage landscape, enlisting the expertise of a specialised mortgage broker can be a game-changer. Unlike traditional borrowers with steady pay slips, self-employed applicants often face unique challenges when seeking home loans. Here's why partnering with the right mortgage broker can be particularly advantageous for self-employed borrowers:

Understanding Complex Income Structures: Self-employment often involves intricate income structures, such as irregular earnings, business expenses, and fluctuating profits. The right mortgage broker will specialise in deciphering these complexities, presenting your financial situation in the most favourable light to lenders.

Access to Specialised Lenders: Many traditional lenders may view self-employment as a higher risk, leading to stricter lending criteria and potentially higher interest rates. Mortgage brokers, however, have access to specialised lenders who understand the nuances of self-employment and offer tailored loan products with more flexible terms.

Tailored Loan Solutions: A mortgage broker will work closely with you to understand your specific financial goals and circumstances. They can then source loan options that align with your needs, whether it's a low-doc loan, asset-based lending, or other specialised products designed for self-employed individuals.

Expert Guidance and Support: Navigating the mortgage application process as a self-employed borrower can be daunting. A mortgage broker acts as your advocate, providing expert guidance and support every step of the way. From gathering documentation to negotiating terms with lenders, they ensure a smoother, less stressful experience.

Maximizing Approval Chances: The right mortgage broker knows which lenders are more inclined to approve loans for self-employed applicants. By strategically matching you with the right lender and presenting your financial profile effectively, they enhance your chances of loan approval.

In conclusion, for self-employed individuals in Australia, navigating the mortgage market can be challenging due to complex income structures and varying lender requirements. However, by partnering with a knowledgeable and specialised mortgage broker, self-employed borrowers gain access to other lenders, tailored loan solutions, and expert guidance tailored to their unique financial circumstances. With the support of a mortgage broker, self-employed applicants can confidently navigate the loan process, maximize their approval chances, and ultimately achieve their dream of home ownership.

How does the decision impact you?

RBA rate decisions play a pivotal role in shaping borrowing costs, consumer sentiment, and property market dynamics, influencing borrowers' financial decisions accordingly.

If you would like to discuss what today’s decision means for you and your finances, please feel free to contact me.

For those looking to buy their first or next property in 2024 or considering refinancing, assistance is available.

Let us compare market offerings to find home loans tailored to your specific needs and financial goals.