2024 Federal Budget & What It Means for You

The 2024 Federal Budget was announced on Tuesday 14 May 2024, with a focus on cost-of-living relief (again) and clean energy.

There were no new tax or superannuation changes announced, and the previously announced Stage 3 Income Tax cuts were confirmed to begin on 1 July 2024.

Here is a brief summary of the Budget updates:

Individuals

- Household Energy Rebate: The Government will provide a $300 rebate to all Australian households on 2024/25 energy bills to provide cost of living relief. This won’t be cash to you – but it will be $75 per quarter paid to your energy company by the Government.

- Medicare Levy Low-Income Thresholds Increased: The Government will increase the Medicare Levy low-income threshold for everyone from 1 July 2023. This means all individuals will now pay slightly less tax.

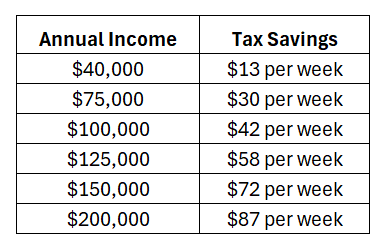

- Revised Stage 3 Tax Cuts for Individuals: The Government confirmed the revised Stage 3 Tax Cuts will begin on 1 July 2024. Here is a summary of the tax cuts you will receive based on your earnings. More money in your pocket each week!

- Deeming Rate Freeze Extended: The deeming rate is the Government’s assumed return on a retiree’s investments. The top rate of deeming will be held at 2.25% for another 12 months. Half a million pensioners can relax, the deeming rate is staying unchanged for next year.

- Supporting Students – Lower HECS Indexation: The Government will cut $3 billion in student debt for more than 3 million Australians. The Government will cap the HELP indexation rate to be the lower of either the Consumer Price Index or the Wage Price Index – expected to be around 4% for 2024 instead of 4.7%. The Government will backdate this relief to all HELP, vocational education and training (VET) Student Loan, Australian Apprenticeship Support Loan and other student support loan accounts that existed on 1 June 2023. Your HESCS / Student Loan may grow over time if no compulsory or voluntary repayments are made.

Superannuation

- Increased Employer Super: While this isn’t a Budget announcement, this is a good opportunity to remind you that your employer is required to pay 11.5% of your salary (up from 11%) into your superannuation from 1 July 2024. Please remember if you have a salary package that is inclusive of super, then your take-home pay effectively reduces by 0.5% from 1 July 2024 – but remember this will be offset by the Stage 3 personal tax cuts also coming into effect on 1 July 2024.

- New Super Contribution Caps: While there were no superannuation reforms contained in this year’s Budget, the super contribution caps were given an inflation adjustment. The tax-deductible super cap will increase from $27,500 to $30,000 on 1 July 2024, and the non-tax deductible super cap will increase from $110,000 to $120,000 per year. You will be able to contribute $2,500 more into super as a tax deduction from 1 July 2024.

NEXT STEPS

Australia is currently facing a turbulent financial future, with inflation and interest rates still high as the nation faces a housing crisis.

With this uncertain future, it’s important that you try to build up a cash reserve and ensure your finances are in good order.

Our expert team of accountants are here to help you.

Please contact us TODAY if you have any questions about this 2024 Federal Budget and how it affects you, planning for your upcoming 2024 Tax Returns, and saving tax, growing and protecting your family wealth.