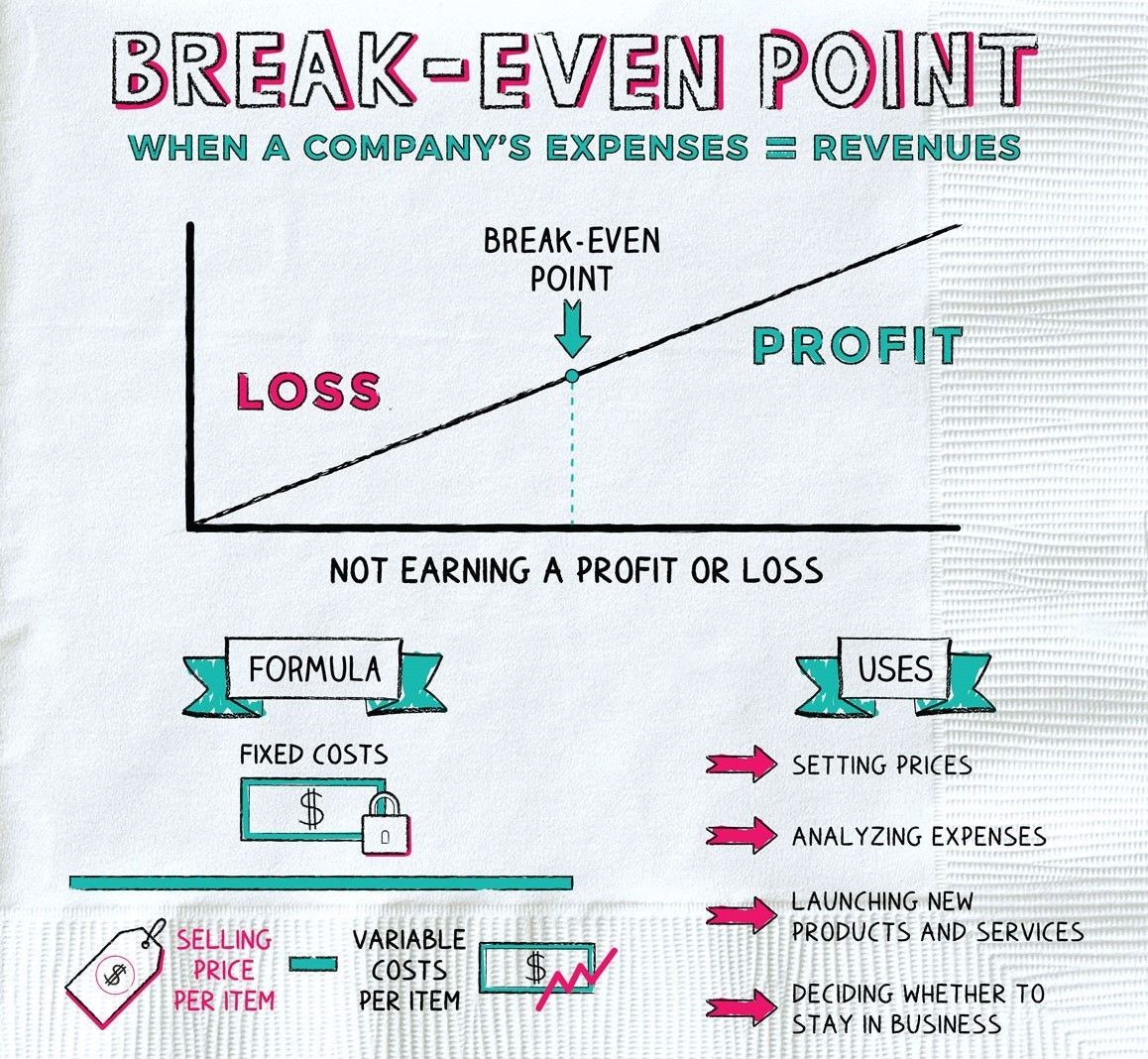

Understanding Your Breakeven Point

Understanding your business breakeven point is essential to know how much money you need to make to stay in business. It can therefore help you make well-informed financial decisions and practical business plans.

The breakeven point is the income or sales needed to cover all costs. Any earnings above this point generate profit. So your breakeven point tells you the minimum sales required to continue operating a viable business.

Understanding the breakeven point in conjunction with financial reports can give you valuable data to analyse fixed and variable costs and set sales targets for the business or individual staff members.

Fixed and Variable Costs

- Fixed costs - remain the same regardless of how many sales you make. Expenses like rent, equipment lease repayments or full-time staff have to be paid whether you sell any goods or services or not. Fixed costs are often called overheads.

- Variable expenses - (sometimes called production costs) fluctuate based on sales. For example, cost of goods sold, production labour, and commissions paid to salespeople will vary according to the number of goods or services sold.

It's helpful to work out an amount or percentage of variable costs compared to the sale price of your products or service. This may not be exact initially, but even if you get a rough figure to work with, this will help calculate your breakeven point. Over time as you analyse your financial reports, you’ll be able to refine the calculation and adjust your selling price accordingly.

How to Calculate Break even

You’ll need to know your fixed costs (overheads), selling price and production costs.

One common method of calculating breakeven is as follows:

- Overheads / (selling price – production cost)

For example, let’s say overheads per month (rent, vehicle lease, administration staff) are $20,000, and you sell a coaching program for $3,000 with variable costs (coach fees, handout materials for participants, advertising) of $1,500 per program.

- $20,000 / ($3,000 - $1,500) = 13.33

You would need to sell over 13 programs per month to break even, which equates to $40,000 worth of sales.

If the same program had variable costs of $1,800, you would need to sell 17 programs per month to generate $50,000 worth of monthly sales just to cover costs. Variable costs of $1,000 per program would mean you only need to sell 10 per month to break even.

With these examples, you can see how important it is to understand your fixed and variable costs. Then you'll know exactly how much you need to make to remain in business and the resulting impact on your financial position. Once you have a reasonably accurate breakeven figure, you can quickly calculate your profit before tax for sales above the breakeven point. In the example where variable costs are $1,500 per program, let’s say you sell 20 programs each month. This would result in an extra $10,000 in profit (before tax) after paying for overheads and variable costs.

Can breakeven help with your pricing?

Understanding your breakeven point can give you some deep insights into your selling prices, helping you understand if they’re realistic.

For example, if your variable costs are high, how much more income will you need to reach breakeven. Is there a fair price for consumers that covers your expenses in a reasonable time frame? Do you need to raise prices to account for fixed and variable costs accurately?

Talk to us about calculating your breakeven point

There are different ways of calculating your breakeven point to confirm the viability of your business, and the ideal pricing point for driving both sales and profitability.

We'd love to help you understand your business financials in more depth, so you can plan for long-term sustainability, enjoyment and profitability.